Special Note: Does your company pay Seattle’s Payroll Expense Tax? If you have any questions or concerns, email us here.

Last month, the Seattle City Council voted to increase the Payroll Expense Tax by 6.5%.

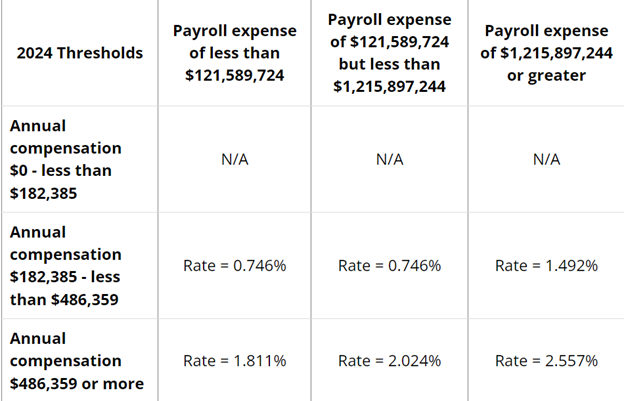

On Jan. 1, 2024, the Payroll Expense Tax Rate will increase by 0.1% to 0.2% per tier. For example, tier one will increase from 0.7% to 0.8% and so on. See the chart below for tier information:

Reminder: Each year the Payroll Expense Tax thresholds may increase based on the annual Consumer Price Index.

Who pays the tax in 2024?

- Businesses with $8,511,281 or more in payroll in 2023, and

- At least one employee with compensation of $182,385 or more in 2024

Businesses that do not meet those criteria do not need to file or pay this tax, but they are still responsible for filing and paying other general business taxes.

Businesses need to file a 2024 Payroll Expense Tax Quarterly Filing Form, or online on the city’s website.